The World Bank's Coal Electricity Headache

Written by:

Shakeb Afsah and

Kendyl Salcito • May 24, 2011

Topic: World Bank; energy; power plant; supercritical

Corresponding author: Kendyl.Salcito@CO2Scorecard.org

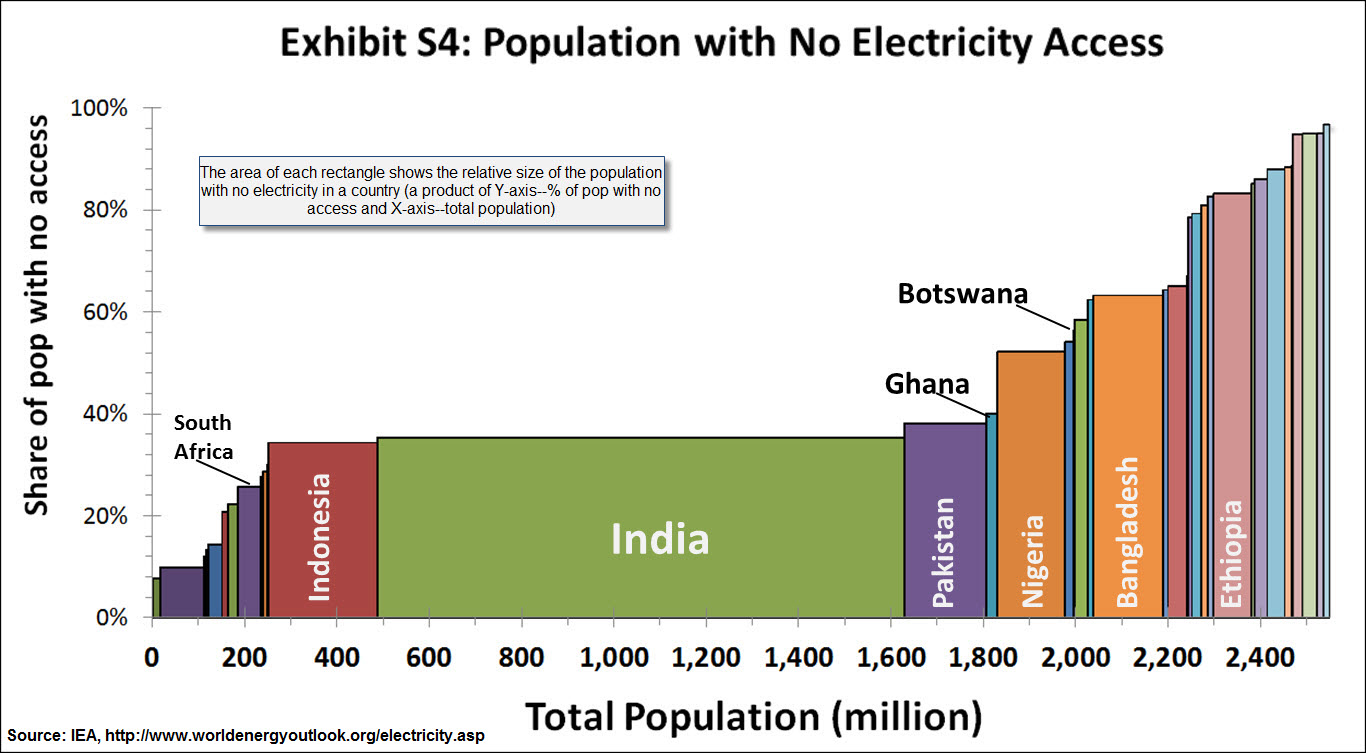

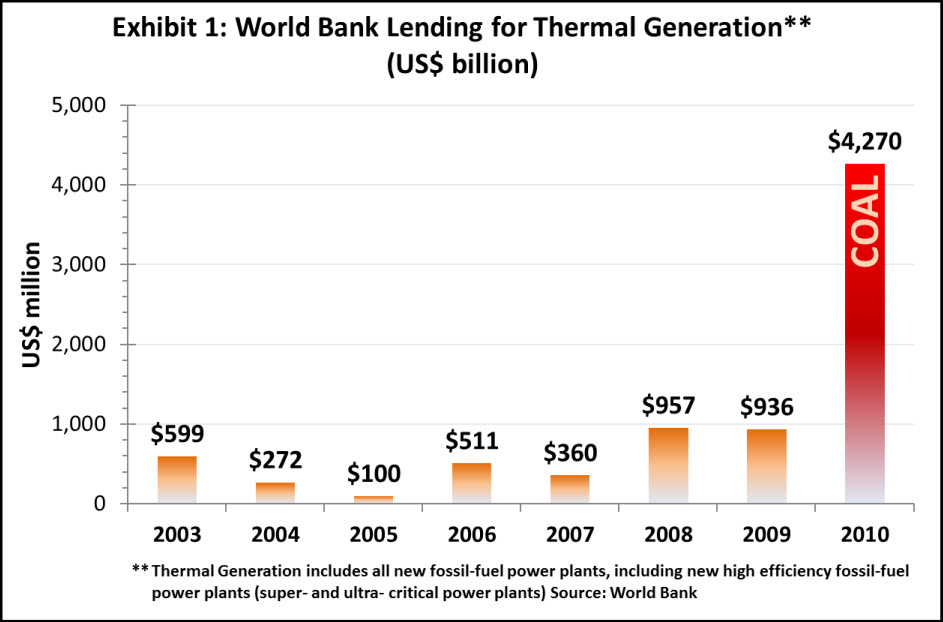

It has been widely reviewed, reported, and vociferously condemned that the World Bank Group (WBG) is investing heavily in coal. In South Africa, Botswana and India, the Bank has issued over $4 billion in loans for new coal-fired power plants since 2008. As a result, the Bank’s brand name is now tied to more than a billion tons of CO2 emissions over the next four to five decades.

Since energy use and economic development are inter-linked, coal may be a necessary step in equalizing development opportunities for the poorest. Demonstrating that supercritical coal technology is a genuine cleaner option and provides energy access to poor people would be worthy of global congratulations. But can the Bank do it? So far, the outlook is not good.

Since energy use and economic development are inter-linked, coal may be a necessary step in equalizing development opportunities for the poorest. Demonstrating that supercritical coal technology is a genuine cleaner option and provides energy access to poor people would be worthy of global congratulations. But can the Bank do it? So far, the outlook is not good.

The Bank has repeatedly justified its coal-fired power plant investments as (1) cleaner than old coal, and (2) vital to improving access for the poor. Our findings contradict both these claims. Empirical evidence of cleaner technology credentials is hard to come by for the supercritical power plants touted by the WBG; 40-year-old plants frequently outperform their new, highly-promoted counterparts. We also show that stipulations for power plant investments in Botswana, India, and South Africa are inadequate for ensuring electricity access to the poor.

Given the significance of these findings, we encourage the WBG to disprove our analysis by adopting a rigorous monitoring plan to track and publicly report the CO2 emissions and energy access gains from its investments. This kind of transparency will be consistent with the recently adopted open-data principle at the World Bank and will further help the bankers prove that their investments live up to expectations.

Coal plant investments have put the WBG between a rock and a hard place. The tradeoff between reduction in energy poverty and CO2 emissions became a major dilemma for the WBG during its energy strategy consultation: coal is cheap and poor countries will naturally continue investing in this carbon-intense power source. The WBG has felt compelled to contribute, but its own technocrats recommend that the Bank restrict future investments in coal plants to the point of near embargo—the exceptional case doctrine. Our analysis bolsters that recommendation. However, for the sake of credibility the Bank must provide a very clear and unambiguous definition for “exceptional,” even if prominent member countries balk at such measures of clarity.

Supercritical: A cleaner technology illusion?

With the anticipated release of the final World Bank Energy Strategy, the Bank is trying to preempt more inevitable negative press. Bank documents increasingly call coal by euphemisms. Thermal power, “supercritical technology,” CCT - they’re all coal. Recently, the Bank indicated that coal projects would only be supported in the poorest countries, where the need is the greatest. It’s a start, but it does not ensure that coal investments will translate into measurable improvements in access to electricity for poor people in those nations, nor does it ensure that the modern supercritical technology itself will be up to snuff.

Power plants using modern supercritical boilers and turbines are increasingly pitched as “cleaner coal technology.” According to IFC, supercritical technology to be used in India’s Tata Mundra project will release 0.75 tons of CO2 per MWh of electricity generated. But IFC’s benchmark is a tall order if the performance of new supercritical power plants that went online in the US is any indicator.

Power plants using modern supercritical boilers and turbines are increasingly pitched as “cleaner coal technology.” According to IFC, supercritical technology to be used in India’s Tata Mundra project will release 0.75 tons of CO2 per MWh of electricity generated. But IFC’s benchmark is a tall order if the performance of new supercritical power plants that went online in the US is any indicator.

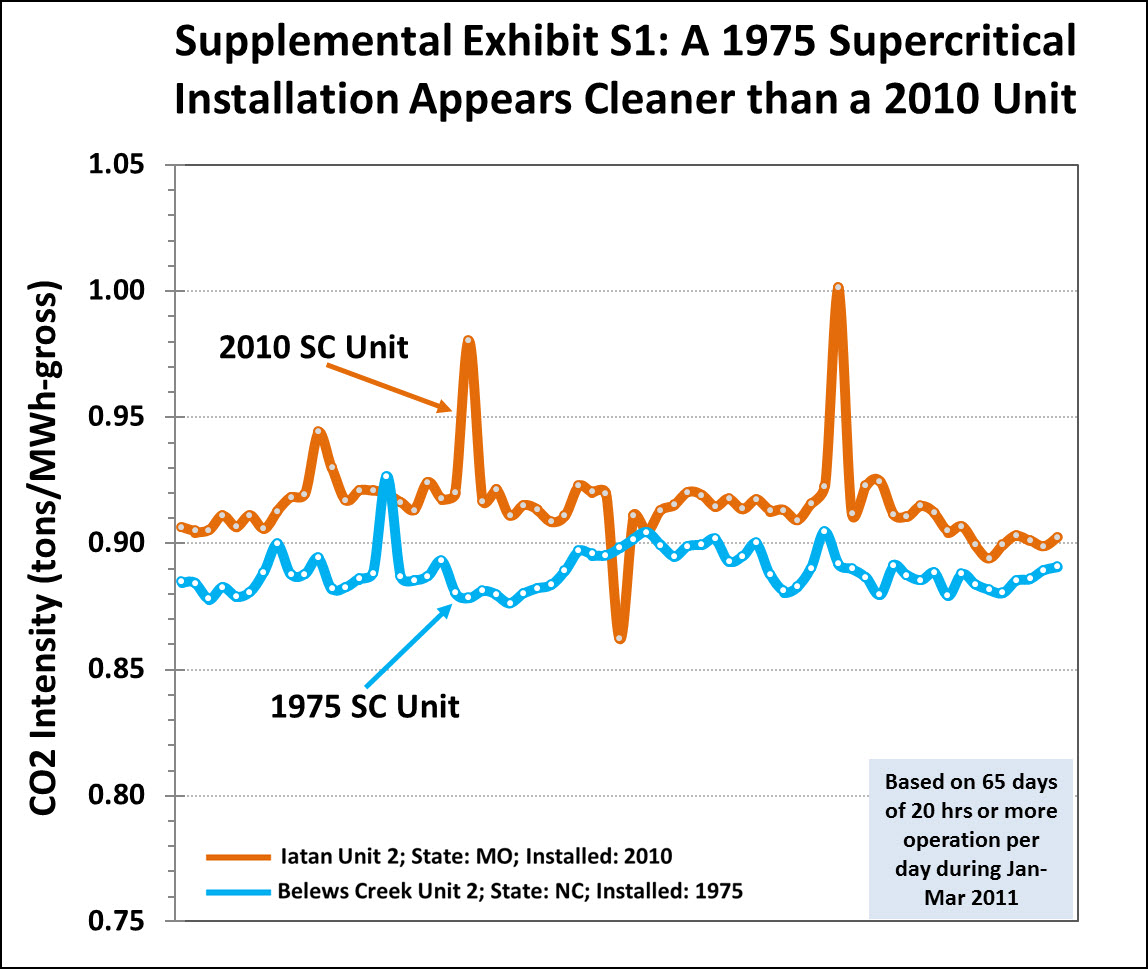

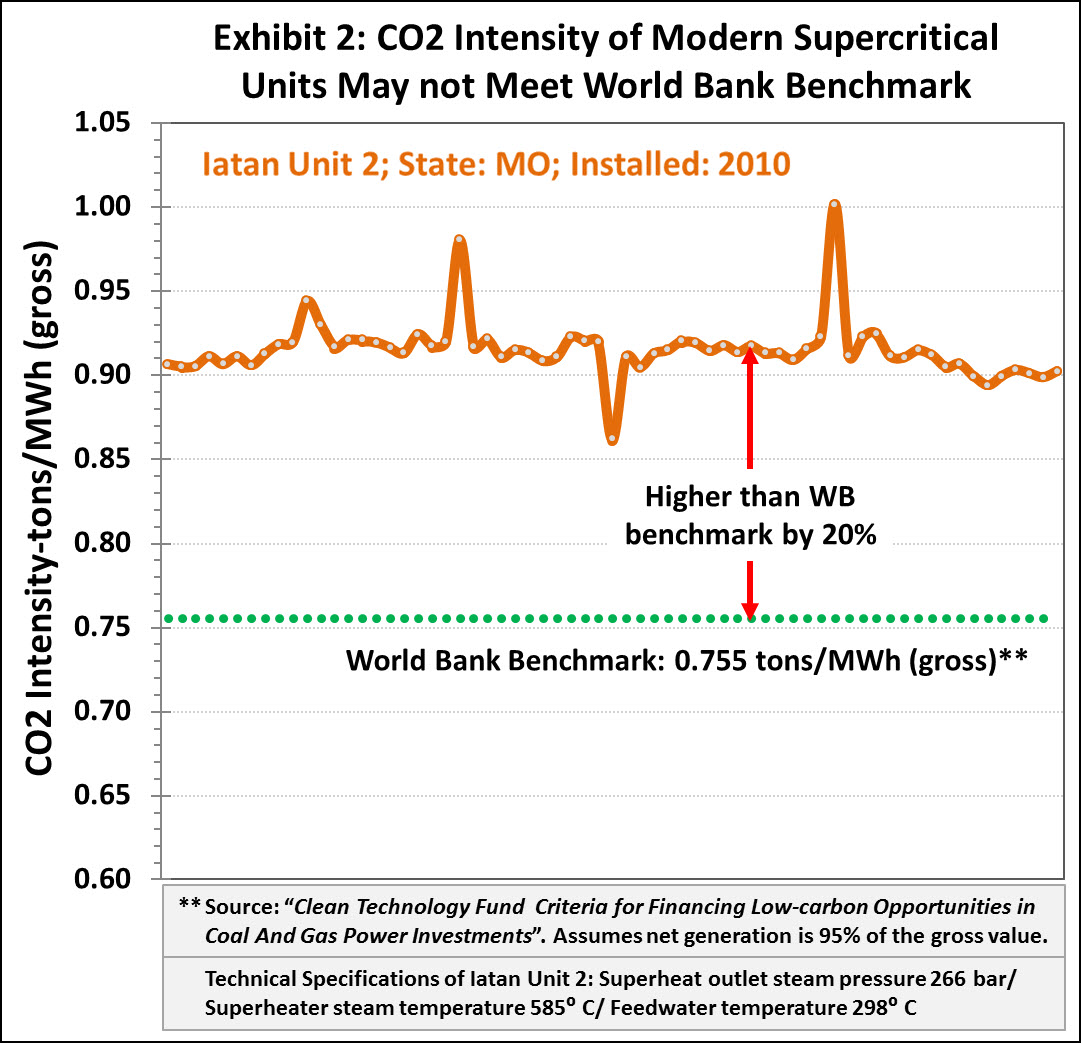

As illustrated in Exhibit 2, the 850 MW advanced supercritical unit “Iatan 2[1]” that started commercial operations in 2010 generated, on average, 0.91 tons of CO2 per MWh of gross output in the first quarter of 2011 (source: USEPA/CAMD preliminary data release). This output could rise above 0.96 tons if the intensity is calculated on a net output basis. This new unit exceeds the CO2 intensity guidelines by 20%, while its technical specifications remain comparable to the reference cited by the World Bank’s Clean Technology Fund[2]. Its CO2 intensity is higher than several supercritical units from the 70s vintage (see an example in supplemental Exhibit S1).

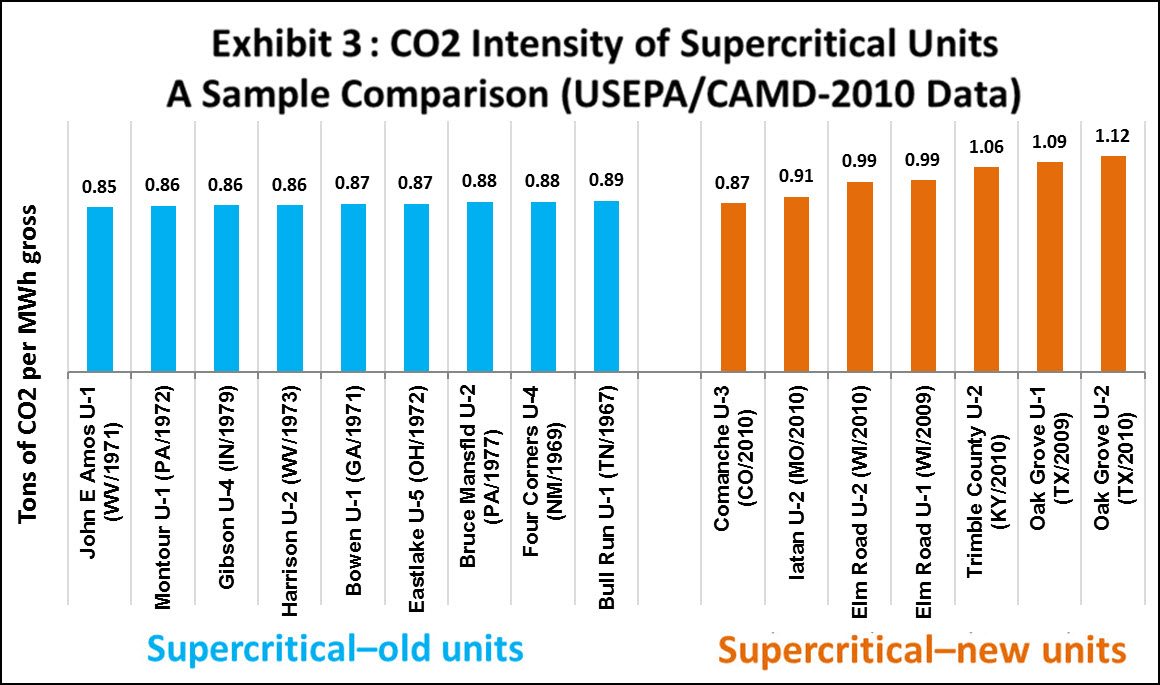

Given the rave reviews that the modern supercritical technology has received, one would expect these new generation installations to be systematically better that their older counterparts. Instead, several US plants built between 1960 and 1980 are operating equally or more carbon-efficiently, compared to the supercritical plants that have gone online since 2009 (Exhibit 3). This is not because the supercritical technology offers no improvements, but because it has been used since the 1960s. A statistical comparison of the CO2 intensities of new supercritical units with a broad sample of one hundred supercritical units installed during the period 1960-80 helps illustrate the performance stagnation over the past 50 years (supplemental Exhibit S2). More than half of the units from the 60s and the 70s perform better than the average carbon intensity of the seven units that started operations during 2009-10.

Engineers aver that “Cleaner Coal Technology” has developed significantly in recent years. It may be theoretically possible to achieve an average CO2 intensity of 0.75 tons/MWh, and there is no doubt that the supercritical technology has progressed in terms of design and material use, but it is unclear how these advancements have translated into measurable improvements in CO2 intensity— the single most important outcome indicator from a policy perspective.

Engineers aver that “Cleaner Coal Technology” has developed significantly in recent years. It may be theoretically possible to achieve an average CO2 intensity of 0.75 tons/MWh, and there is no doubt that the supercritical technology has progressed in terms of design and material use, but it is unclear how these advancements have translated into measurable improvements in CO2 intensity— the single most important outcome indicator from a policy perspective.

Rebranding has been compelling, but it is not supported by monitoring data. The global understanding of the true operational performance of supercritical plants remains surprisingly low. Top newspapers, like the New York Times, write about “cleaner coal” without citing hard data. A 2008 review of India’s energy sector produced for the World Bank extols the CO2 reducing capability of supercritical plants but these claims are not supported by any empirical data in the document. Such descriptive “evidence” is as typical as it is problematic. As one MIT report highlights, site-specific factors including the quality of coal influence the empirical numbers on CO2 intensity of supercritical units, an important reminder that CO2 intensity estimates developed during pilot tests under ideal conditions and cited as rated performance should not be taken at face value. More fundamentally, it is unclear if it is the quality of coal or the supercritical technology that has more influence on CO2 emissions per unit electricity.

The WBG estimates that a supercritical technology like the Tata Mundra project reduces emissions by around 18% compared to the global average for coal fired power plants, and the Clean Technology Fund (CTF) refers to ultrasuper- and super- critical technology as a part of an emissions reduction continuum, but our data shows it is not even that. Without proven carbon capture and storage (CCS) technology, coal will remain fodder for catastrophic climate change. The Bank is calling for bold action on climate change, but supercritical technology barely nibbles around the edges of the problem.

Energy conservation, energy efficiency, price reforms and real investments in innovative R&D should remain the cornerstone of the long-term energy policy. For the WBG, extra care is needed to justify investments in coal power plants on the basis of comparative cleaner performance, not just because climate change is a priority, but because poverty reduction is a priority too.

More electricity is not always equal to better access

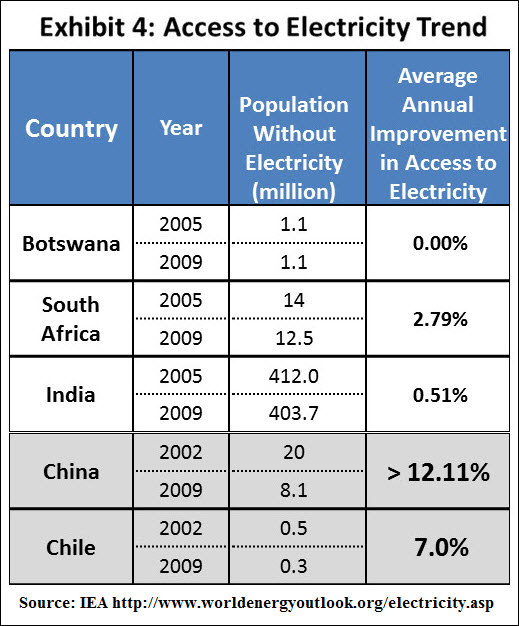

Limited carbon efficiency of supercritical units is accompanied by a significant weakness in the Bank’s effort to reduce energy-poverty. Recent findings from CO2Scorecard show that more electricity generation does not automatically translate to increased access for the poor. In India, for instance, net electricity generation has risen an average of 6% per year since 2005 (source: EIA), while the total population with access has improved by a paltry 0.5% (Exhibit 4; source: IEA). Similar dismal numbers are true for Botswana, where half of the population has no access to electricity – a statistic unchanged between 2005 and 2009 – and rural electrification lags 56% behind urban, resulting in one of the worst disparities in the world. South Africa is having its own power generation issues, but the country managed to increase exports to 14 million MWh in 2008, while 12 million South Africans remained in the dark.

What’s more, the improvements in access, measly though they are, are possibly more reflective of urban migration than improved and lengthened power grids. Once a true accounting of electricity access is conducted, progress in these countries may look even dimmer. In short, new sources of electricity are often monopolized by those who already have access.

What’s more, the improvements in access, measly though they are, are possibly more reflective of urban migration than improved and lengthened power grids. Once a true accounting of electricity access is conducted, progress in these countries may look even dimmer. In short, new sources of electricity are often monopolized by those who already have access.

This is not a necessary outcome. Without Bank support, China initiated a rural electrification program that provided electricity to around 12 million people between 2002 and 2009, achieving more than 12% average annual increase in access (Ying et. al. 2006). In Chile, well-targeted electrification programs for remote villages improved electricity access by around 7% a year between 2002 and 2009. The World Bank’s own rural electrifiation program in Laos that ran from 2005 to 2010 improved electricity acccess at a rate of over 10% a year during the period. Clearly, concerted efforts can lead to improvements in electricity access.

Economic expediency or rural access?

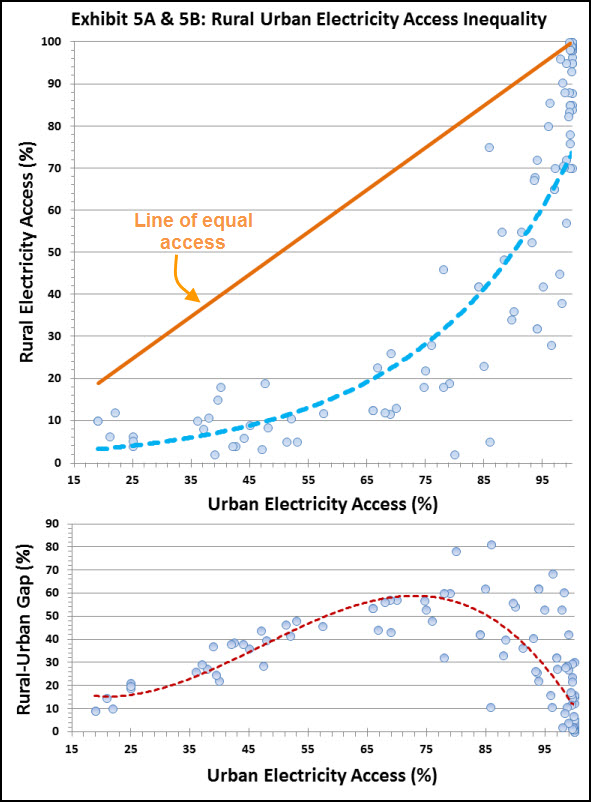

Dr. Fatih Birol, the Chief Economist of the International Energy Agency, sees the shortfall in access as “completely unacceptable.” But there are good reasons why 1.4 billion poor people in this world don’t have electricity. The Bank recognized the challenge in a 2005 paper by Energy and Mining Sector Board Chair and Director of Energy and Water, Jamal Saghir. “In rural areas, remoteness and low density demand raise the costs of electrification to nearly prohibitive levels.” Building power lines to rural areas doesn’t pay,  not just because houses are spread out, but because rural populations are poorer than urban ones – they are less likely to have cash to pay their bills, and they are harder to track down for non-payment. Even subsidizing the tariff rate does not solve the problem. Instead, data show that in an economics-based approach to infrastructure, rural populations are left behind and electrification improves little until upwards of 75 percent of urban households have power as shown in Exhibit 5A. In some cases the gap between urban and rural electricity access is as large as 60% or higher (Exhibit 5B). Left to conventional economics, World Bank’s power plants will barely help.

not just because houses are spread out, but because rural populations are poorer than urban ones – they are less likely to have cash to pay their bills, and they are harder to track down for non-payment. Even subsidizing the tariff rate does not solve the problem. Instead, data show that in an economics-based approach to infrastructure, rural populations are left behind and electrification improves little until upwards of 75 percent of urban households have power as shown in Exhibit 5A. In some cases the gap between urban and rural electricity access is as large as 60% or higher (Exhibit 5B). Left to conventional economics, World Bank’s power plants will barely help.

Mr. Saghir’s 2005 article had a broader, underlying point: “Modern energy has the biggest effect on poverty by boosting poor people’s productivity and thus their income.” Six years later, the new coal projects in Botswana, India and South Africa represent the classic pitfalls in World Bank energy policy, failing to provide modern energy to the people who most need that boost.

In India, the 4000 MW Tata Mundra coal plant will generate approximately 28-30 billion KWh of electricity per year. The Indian government has calculated that a person requires 73 KWh per person per year to meet basic energy needs—mostly lighting at night (source: WEO 2007). With envelope-back math, a fourth-grader could tell you that the scale of Tata Mundra power plant’s electricity output is capable of meeting the basic needs of the 400 million Indians currently without power. Yet only 81,000 new households are promised power from this plant –a mere tenth of a percent of generated electricity is allocated for households with no access.

In South Africa, where the actual power agreement commits to increasing rural electrification, local communities filed a complaint with the World Bank Inspection Panel before the plant was even developed in March 2010. In the complaint, they point out that the 25% tariff increases in electricity are prohibitively expensive for the poor. They also note that a significant portion of electricity is earmarked for export, even as millions of South Africans live without electricity. Subsidies are planned only for households using less than 50 KWh – this is barely sufficient for a household to illuminate a single 60-watt bulb two hours a day. The World Bank replied that it “has no role in the tariff setting process” and that the government is responsible for financing new connections for residents not receiving electricity. By taking no ownership in the human outcomes of the project, it is very difficult to state that the project’s aim is to improve development and reduce poverty. Who, if not poor people, are to be the beneficiaries?

The implications of our findings are deeply problematic for the World Bank projects. The Bank has repeatedly justified its coal-fired power plant investments as cleaner than conventional coal, and vital to improving access for the poor. Now those claims are up in the air. It is unclear if the power plants in Botswana, India and South Africa will comply with the CO2 intensity estimates touted by the Bank or the energy access aspirations of the projects.

Yet coal cannot be eliminated from the Bank’s portfolio. Coal remains the cheapest, easiest way to produce energy. In poor countries, cheap and easy are prerequisites for energy development. Even in the controversial project in Botswana, the need for coal is tangible and palpable for citizens. South Africa will phase out energy exports to Botswana by 2012. Botswana urgently needs a quick fix to replace upwards of 70% of the country’s energy, which was previously supplied by South Africa’s Eskom. The World Bank wants to reduce greenhouse gas emissions, but not at the cost of Botswana’s wellbeing. If coal use is to be justified, it must demonstrably reduce poverty and improve lives.

That’s right. Monitoring.

As the Draft Energy Strategy paper notes, “Making significant progress on the access and sustainability objectives demands a clear departure from existing policies and approaches. The challenge is formidable.” Serious risks need to be taken if the Bank is to have a real impact on poverty through its massive investments in coal-fired power plants.

What the Bank needs are clear targets for energy access, reliability of electricity supply to the poor and carbon output, to indicate that coal investments support long-term goals. Estimating what portion of energy produced by Bank-funded projects should go to the poor, and monitoring the implementation, the Bank could become aware in near real-time of its impacts on electricity consumption inequality and CO2 emissions. Current evaluations by the Independent Evaluation Group (IEG), which mostly serve to provide ex-post-facto analysis, are inadequate.

Monitoring should track emissions closely. Current World Bank documents promise that new power plant investments are low-emitting, “cleaner coal” projects. To support this claim, the World Bank and the IEG should collect daily emissions data and publicly release it monthly or quarterly—this would reflect the true spirit of the Bank’s open-data initiative. For years CO2Scorecard has emphasized that there is no substitute for on-site monitoring of emissions. Many private firms and public agencies have adopted our recommendations, to their benefit and the globe’s. Following suit would show that the World Bank is serious about the environmental effects of its projects.

If these monitoring efforts prove that the World Bank’s coal investments reduce energy poverty and operate more cleanly than they have in the past, opponents will have little traction for their anti-coal criticisms. If monitoring reveals that CO2Scorecard’s analysis is accurate, modifications can be made to reduce carbon emissions. This is the basis for an infrastructure and governance approach built on the principles of rigorous monitoring and disclosure.

India presents a good example. The Tata Mundra coal plant promises electricity for 81,000 new households. This is not an ambitious target, but if this goal is not met, a lesson has been learned. Even if it is met, it must stand against an emissions monitoring test.

At stake is not only the Bank’s ability to address climate change but also its ability to learn from past mistakes. Institutional memory appears to be fading. Nearly 20 years ago a similar debate surrounded the value and poverty-reduction impact of generating electricity from dams. The Bank spent an estimated $75 billion building large dams in nearly 100 countries. Facing opposition both inside and outside its ranks, the Bank appointed a commission to study the effectiveness of dams. Their report found that half of hydroelectric dams produced significantly less power than promised. Even more tellingly, in one case energy went to transnational corporations operating within developing countries, not to the local people themselves. A quarter of water-supplying dams delivered less than half what their brochures claimed, and a quarter of irrigation dams irrigated less than a third of the land intended. Average cost overruns were 56%. The hype surrounding supercritical coal plants mirrors the enthusiasm for dams in the 1980s and 1990s. The outcomes need not be the same.

If monitoring reveals politics

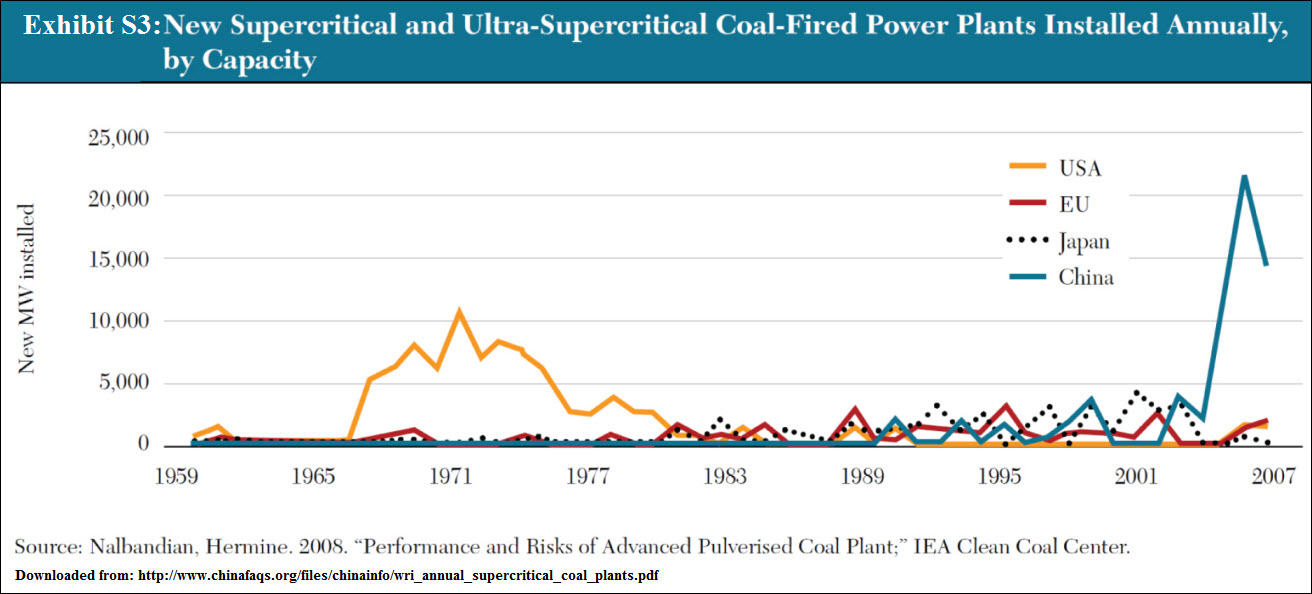

Observers of Bank policy recognize that the World Bank’s hesitant approach to climate change is a result of conflicts among its member countries. The Energy Strategy rollout has been delayed, partly because China, among others, opposed restrictions on funding for coal fired power plants. Though China does not need World Bank financing for coal plants, it is the world’s largest user of supercritical technology (supplemental Exhibit S3) and a major emerging supplier. It may be looking for a green light from the Bank to sell its technology around the globe or it may fear a slippery slope of crackdowns on coal use in the future. This is a natural stance reflecting industry interest but it comes at a huge price for the world. Meanwhile, not a single operating Chinese supercritical plant has submitted CO2 emissions data for public scrutiny, and access to Chinese environmental data remains difficult.

Brazil, like China, is against limiting investment in coal power plants to the poorest countries, but Brazil’s obstruction is attributed almost solely to politics. Brazil’s electricity comes largely (85%) from hydropower; only 2.3% of its electricity comes from coal – less than from nuclear, gas or oil. On the surface it would seem Brazil would benefit from the reduction in coal plants worldwide. If Brazil is voting in solidarity with middle-income countries, anti-OECD sentiment is becoming a barrier to climate friendly development.

If monitoring reveals undesired outcomes

The worst that could come of a rigorous monitoring operation would be the discovery that some coal plants fail to increase access and limit CO2 emissions. Having this information from the moment a plant starts operation provides a world of opportunities for corrective actions for policymakers and project managers.

The limits of power generation can be overcome with infrastructure improvements, for example. More than 30% of India’s electricity is stolen or lost to grid flaws. If improving the grid and reducing theft could increase electrical output to 81,000 new households with no increase in emissions, the Bank has a clear next move: fix the grid before building new coal plants. This would have been a wise move before plugging any modern supercritical technology into a super-obsolete grid (Exhibit 6), as the Independent Evaluation Group (IEG) has pointed out. Conducting a retroactive study of five WBG-funded power plants in its Climate Change Report, the IEG came out strongly against coal investments specifically because they were not the lowest-cost, highest-efficiency option for power availability when pollution is taken into account. Anticipatory study would have preempted these sub-optimal investments.

The limits of power generation can be overcome with infrastructure improvements, for example. More than 30% of India’s electricity is stolen or lost to grid flaws. If improving the grid and reducing theft could increase electrical output to 81,000 new households with no increase in emissions, the Bank has a clear next move: fix the grid before building new coal plants. This would have been a wise move before plugging any modern supercritical technology into a super-obsolete grid (Exhibit 6), as the Independent Evaluation Group (IEG) has pointed out. Conducting a retroactive study of five WBG-funded power plants in its Climate Change Report, the IEG came out strongly against coal investments specifically because they were not the lowest-cost, highest-efficiency option for power availability when pollution is taken into account. Anticipatory study would have preempted these sub-optimal investments.

The monitoring need not stop at coal plants. Given the tradeoff between poverty reduction and CO2 emissions, the Bank should consider a rigorous monitoring approach for its entire portfolio of projects, so that the CO2 emissions of its energy intensive projects can be quantified and balanced out by projects that reduce poverty. This is the kind of innovation that would help the World Bank live up to its bold mission statement. Creating a comfort level with high-resolution monitoring and a culture of accountability would be challenging but extremely valuable in the long term. The time is right for the Bank to incorporate these courageous ideas in its forthcoming energy strategy document.

The dodgy doctrine of “exceptional cases”

As the WBG finalizes its energy strategy, it should establish transparent rules and criteria for funding power plant projects. As of now it remains unclear why the WBG chose to fund power plants in Botswana, India and South Africa while declining to support a coal project in Pakistan. Factors behind such decisions should become self-evident.

By committing to further limit its coal fired power plants to “exceptional cases” the Bank has, perhaps unknowingly, committed to justifying its future coal investments. Any ambiguity in the definition of “exceptional cases” will be met with ire from countries whose coal aspirations go unfulfilled. In defining exceptionality, the IEG recommends straightforward ground rules: Coal support should be a last resort used only when lower cost and concessionally financed alternatives have been exhausted and when there is a compelling case that WBG support would reduce poverty or emissions.

The devil is going to be in the details as the Bank tries to apply its “exceptional cases” principle to the process of project identification. To avoid the pitfalls of the past projects, the WBG must embrace the principles of monitoring and disclosure we recommend. It must show that its projects meet the standards of exceptionality, both when they are commissioned and as they operate. A system of rigorous, ongoing operational monitoring will create incentives for the Bank’s project managers to pay more attention to project design during appraisal – in essence, it will ensure that poverty and emissions reduction targets are established in advance and are realistic. No project manager wants to see her predictions outshine her project’s performance. Monitoring that shows plants operating according to predicted stipulations will help justify well-made investments. If the Bank’s coal investments actually reduce emissions and poverty, they will be above reproach.

Until the Bank publicly recognizes its struggle to slow climate change while speeding development, its energy portfolio will seem schizophrenic, not balanced. Incentives to make the World Bank’s books look good remain strong, but as the Bank adopts a role in meeting Millennium Development Goals and other social benchmarks, the human side is increasingly relevant. President Zoellick is in a politically complicated position, but he must show a willingness and a capability to tackle climate change from both its socio-environmental and economic sides. Without strong leadership on the issue, the Bank will face sharper, and firmer-founded, criticism. Coal plants cannot be allocated on the basis of political relationships or strategic interests. Only a rigorous monitoring and disclosure system can validate the investments choices the Bank makes. In moving forward it will be up to the World Bank to ensure that its future is not a carbon copy of its past.

References

All sources are hyperlinked

Related Links

“Development Funding Done Right,” Center for American Progress, 2010

“World Bank loans exacerbate climate change,” Bank Information Center, 2009

“Banking on Coal,” Foreign Policy, 2009

“The Carbon Numbers Game,” Bloomberg Markets Magazine, January 2011

Data Notes

All the data on power plants, energy use, electricity supply and CO2 emissions used in this research note are from the CO2 Scorecard Knowledgebase compiled and integrated from many public sources including the World Bank, USEPA, US-EIA, IEA, NETL-DOE, Central Electricity Authority-India, public reports and published papers.

[1] Iatan 2 operates at steam pressure and temperature conditions of 26.6 MPa/585⁰C (installed by Kansas City Power & Light in Weston, Missouri).

[2] For a modern supercritical power plant Clean Technology Fund criteria cites steam/temperature conditions of 25 MPa/560⁰C and a CO2 intensity of 0.8 tons/MWh net.

Supplemental Charts